A warning from the New York State on their website informs visitors that:

“Scammers are calling, mailing, and texting taxpayers about income tax refunds, including the inflation refund check.”

Here’s the warning on the website:

We can confirm that several phishing campaigns are exploiting a legitimate initiative from New York State, which automatically sends refund checks to eligible residents to help offset the effects of inflation.

Although eligible residents do not need to apply, sign up or provide personal information, the scammers are asking targets to provide payment information to receive their refund.

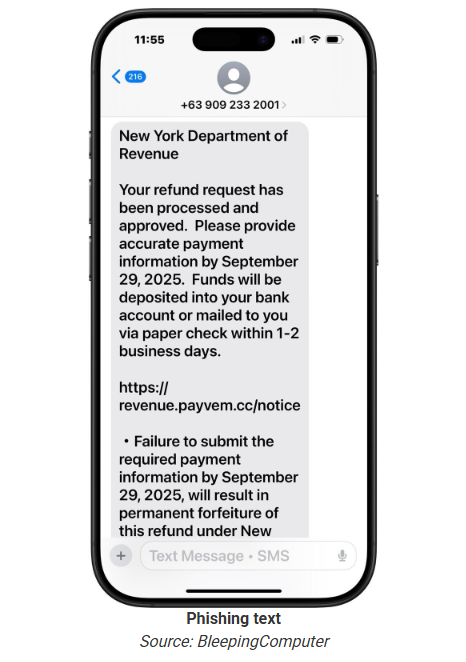

BleepingComputer reported an example of a SMS-based phishing (smishing) campaign with that objective.

“New York Department of Revenue

Your refund request has been processed and approved. Please provide accurate payment information by September 29, 2025. Funds will be deposited into your bank account or mailed to you via paper check within 1-2 business days.

URL (now offline)

- Failure to submit the required payment information by September 29, 2025, will result in permanent forfeiture of this refund….”

As you can see, it uses all the classic phishing techniques: you need to act fast, or the consequences will be severe. The sending number is from outside the US (Philippines) and the URL they want you to follow is not an official one (Official New York State Tax Department website and online services are under tax.ny.gov).

If recipients click the link, they are directed to a fake site impersonating the tax department, which asks for personal data such as name, address, email, phone, and Social Security Number—enough information for identity theft.

Scammers typically jump at opportunities like these—situations where people expect to receive some kind of payment, but are uncertain about the process. By telling victims they need to act fast or they will miss out, they hope to catch targets off guard and act on impulse.

How to stay safe

- Never reply to or click links in unsolicited tax refund texts, calls, or emails.

- Do not provide your Social Security number or banking details to anyone claiming to process your tax refund.

- Legitimate inflation refunds are sent automatically if you’re eligible, there are no actions required.

- If in doubt, contact the alleged source through known legitimate lines of communication to ask for confirmation.

- Report scam messages and suspicious contacts to the NYS Tax Department or IRS immediately.

- Use an up-to-date real-time anti-malware solution, preferably with a web protection component.

Pro tip: Did you know that you can submit scams like these to Malwarebytes Scam Guard? It immediately identified the text shown above as a scam.

We don’t just report on threats – we help safeguard your entire digital identity

Cybersecurity risks should never spread beyond a headline. Protect your—and your family’s—personal information by using identity protection.