According to the crypto bug bounty and cybersecurity firm Immunefi, hackings accounted for $335,574,150 in losses in November 2023, involving 18 incidents.

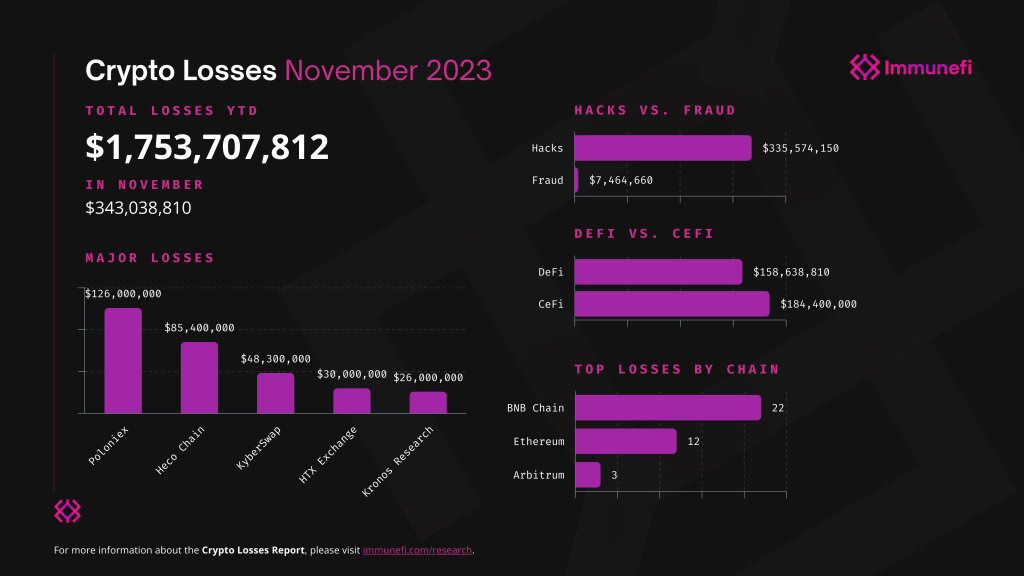

The world’s leading blockchain cybersecurity platform, Immunefi, has published its Crypto Losses in November 2023 Report, according to which cryptocurrency losses have surpassed $1.75 billion due to hacks and rug pull attacks between January and November 2023. This includes 296 distinct incidents. The cryptocurrency ecosystem has witnessed $1,753,707,812 in losses year-to-date (YTD) across 296 specific incidents.

The report is quite concerning. It comes at the same time when the cybersecurity firm Unciphered discovered a critical vulnerability, dubbed ‘Randstorm,’ that has put billions of dollars in Bitcoin and crypto assets at risk due to outdated wallets.

In Immunefi’s October 2023 report, the Singapore-based Immunefi revealed that cryptocurrency attacks surged by 153% year-over-year in Q3 2023. The two largest exploits targeting Multichain and Mixin Network collectively accounted for 47.5% of all losses. The North Korean state-sponsored hacking group Lazarus Group’s cyberattack represented 30% of the total losses, with $208.6 million in stolen funds.

According to Immunefi’s latest report (PDF), a record-breaking $343 million was lost to fraud and hacks in November 2023 alone, making it the highest monthly loss this year, representing a significant 15.4x increase from October 2023’s losses that amounted to $22 million.

Hackings accounted for $335,574,150 in losses in November 2023, involving 18 incidents. This highlights that hacking poses a persistent threat in the cryptocurrency space.

On the other hand, fraudulent activities resulted in losses of $7,464,660 in 23 separate incidents, which is comparatively lower than hacking but remains a concerning issue in the industry.

In a notable shift, Centralized Finance (CeFi) emerged as the primary target for exploits in November 2023, surpassing Decentralized Finance (DeFi) in lost funds. Immunefi found that CeFi accounted for 53.8% of overall losses, whereas DeFi accounted for 46.2%. These spikes are primarily attributed to high-profile attacks on platforms like HTX Exchange, Poloniex, and Kronos Research.

DeFi platforms recorded $158,638,810 in losses in November 2023 in 37 distinct incidents, making DeFi a vulnerable sector. CeFi platforms suffered $184,400,000 in losses in November 2023 in four incidents.

The BNB Chain and Ethereum blockchains remained the most targeted platforms in November 2023, accounting for more than half (83%) of the total losses in all targeted chains.

BNB Chain became a target of 22 incidents, leading to losses of 53.7% of the total losses, whereas Ethereum accounted for 29.3% of the total losses with 12 incidents. Arbitrum, Optimism, Avalanche, Fantom, and Heco Chain each suffered one attack in November 2023, contributing the remaining 2.4% of the total losses.

Immunefi is the premier bug bounty and security services provider, safeguarding Web3 ecosystems and protecting a staggering $50 billion in user funds with its vast network of white hackers.

Immunefi empowers cybersecurity experts to scrutinize project code, detect and responsibly disclose vulnerabilities, and offer rewards for their contributions. This collaborative approach, according to the company, has resulted in the disbursement of over $85 million in total bounties, averting potential losses of over $25 billion in user funds. Since its inception, Immunefi has saved over $25 billion from being stolen.

As an investor in the ever-evolving world of cryptocurrency, DeFi, blockchain, and Web3, it’s crucial to prioritize the security of your digital assets. Here are 5 essential tips to protect your funds from hackers and cyber attacks:

Secure Your Wallets

- Use Cold Wallets: These hardware devices store your private keys offline, making them significantly less susceptible to cyberattacks compared to hot wallets (software wallets connected to the internet). Popular cold wallets include Ledger, Trezor, and KeepKey.

- Diversify Your Wallets: Don’t store all your funds in one wallet. Distribute them across multiple wallets for better risk management.

- Implement Strong Passwords: Use unique and complex passwords for all your wallets and exchanges. Consider password managers for efficient management.

- Enable 2-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second verification factor, like a code sent to your phone, when logging in or making transactions.

Practice Cybersecurity Hygiene

- Stay Vigilant: Be wary of phishing scams, unsolicited emails, and suspicious links. Never share your private keys or seed phrases with anyone, even those claiming to be support personnel.

- Keep Software Updated: Ensure your operating systems, wallets, and other relevant software are updated with the latest security patches.

- Use Secure Networks: Avoid using public Wi-Fi for accessing your crypto accounts. Opt for secure, private networks whenever possible.

- Be Cautious of dApps: Before interacting with any dApp (decentralized application), research its reputation and security practices.

Choose Reputable Platforms:

- Research Exchanges: Before investing in an exchange, thoroughly research its security features, reputation, and regulatory compliance.

- Prioritize Transparency: Choose platforms that prioritize transparency in their operations and code.

- Beware of Unknown Projects: Exercise caution when investing in unfamiliar projects or dApps. Conduct thorough research and due diligence before committing any funds.

Stay Informed and Educate Yourself:

- Continuously learn: The crypto landscape is constantly evolving, so stay updated on the latest security threats and best practices. Follow reliable sources and participate in educational communities.

- Be aware of common scams: Learn about common phishing tactics, exit scams, and other fraudulent activities targeting crypto investors.

- Seek expert advice: If you’re unsure about any aspect of crypto security, don’t hesitate to consult with a trusted security expert or financial advisor.

Backup Your Keys:

- Always have a backup plan: Create backups of your private keys and seed phrases and store them securely offline, preferably in multiple locations.

- Consider multi-signature wallets: These wallets require multiple keys to authorize transactions, offering an additional layer of protection.

Lastly, but most importantly, visit Hackread.com regularly. Follow us on X (formerly Twitter), Facebook, or LinkedIn to stay updated on daily cybersecurity news and threats.

RELATED ARTICLES

- 6 of the Best Crypto Bug Bounty Programs

- Crypto Scammers Exploit Gaza Crisis in Donation Scam

- We Need Smarter Smart Contracts To Prevent DeFi Hacks

- New MortalKombat Ransomware Attack Aiming for Crypto Wallets

- Scammers Use Fake Ledger App on Microsoft Store to Steal $800K

- 8,000 Solana Wallets Drained Millions Worth of Crypto in Cyberattack