Illicit cryptocurrency transactions reached unprecedented levels in 2025 as nation-states weaponized digital assets to evade sanctions, transforming the cybercrime landscape into a geopolitical battleground with record-breaking financial volumes.

According to blockchain analysis data, illicit cryptocurrency addresses received at least $154 billion in 2025, representing a 162% year-over-year increase that establishes a new benchmark for digital finance.

Illicit cryptocurrency transactions reached unprecedented levels in 2025 as nation-states weaponized digital assets to evade sanctions, transforming the cybercrime landscape into a geopolitical battleground with record-breaking financial volumes.

According to blockchain analysis data, illicit cryptocurrency addresses received at least $154 billion in 2025, representing a 162% year-over-year increase that establishes a new benchmark for digital financial crime.

This surge was primarily driven by a dramatic 694% increase in value received by sanctioned entities, though even without this spike, 2025 would have set records across nearly every category of crypto-related crime.

Nation-State Threats Drive Record Volumes

North Korean cyber operatives intensified their cryptocurrency heists to unprecedented levels, stealing $2 billion through sophisticated attacks.

This infrastructure, built on 2024 legislation designed to facilitate sanctions evasion, demonstrates how state actors are creating bespoke blockchain systems to bypass international financial restrictions at scale.

The February Bybit exploit, which netted nearly $1.5 billion, stands as the largest digital heist in cryptocurrency history and exemplifies the regime’s evolving capabilities.

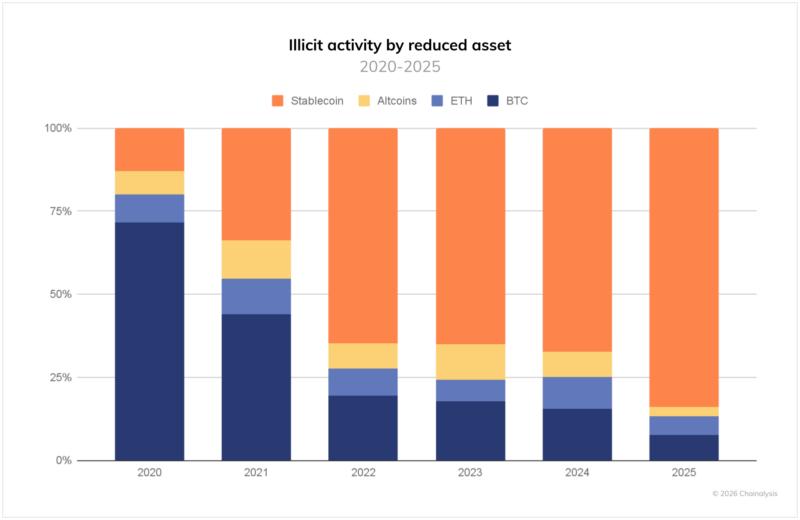

For the past few years, stablecoins have come to dominate the landscape of illicit transactions, and now account for 84% of all illicit transaction volume.

These operations now feature advanced intrusion and laundering tactics that outpace previous years in both sophistication and destructive impact.

Russia’s sanctioned crypto economy achieved massive scale with the February 2025 launch of the ruble-backed A7A5 token, which transacted over $93.3 billion in less than twelve months.

Iranian proxy networks continued their on-chain operations, facilitating $2+ billion in money laundering, illicit oil sales, and arms procurement through cryptocurrency wallets identified in sanctions designations.

Iran-aligned terrorist organizations including Lebanese Hezbollah, Hamas, and the Houthis have expanded their crypto usage to unprecedented levels despite military setbacks.

2025 witnessed the emergence of Chinese Money Laundering Networks (CMLNs) as the dominant force in illicit on-chain ecosystems.

These sophisticated operations have professionalized crypto crime by offering specialized services including laundering-as-a-service and criminal infrastructure support.

Building on frameworks established by operations like Huione Guarantee, CMLNs have created full-service criminal enterprises that support everything from fraud and scams to North Korean hacking proceeds, sanctions evasion, and terrorist financing.

Full-Stack Illicit Infrastructure

While nation-state activity captures headlines, traditional cybercrime remains robust. Ransomware operators, malware distributors, and illicit marketplaces increasingly depend on integrated infrastructure providers offering domain registration, bulletproof hosting, and technical services designed to withstand takedowns and sanctions enforcement.

These platforms have evolved from niche resellers into comprehensive infrastructure ecosystems that support both financially motivated criminals and state-aligned actors, amplifying the reach and resilience of malicious cyber activity.

The virtual nature of cryptocurrency crime is increasingly intersecting with physical violence. Human trafficking operations have expanded their crypto usage.

At the same time, physical coercion attacks where criminals use violence to force victims to transfer digital assets have risen disturbingly, often timed to coincide with cryptocurrency price peaks.

This convergence of digital and physical threats represents a dangerous evolution in crypto-enabled crime.

Follow us on Google News, LinkedIn, and X to Get Instant Updates and Set GBH as a Preferred Source in Google.