Today, the U.S. Federal Trade Commission (FTC) ordered Intuit to stop promoting its software products and services as “free” unless they’re actually free for all consumers.

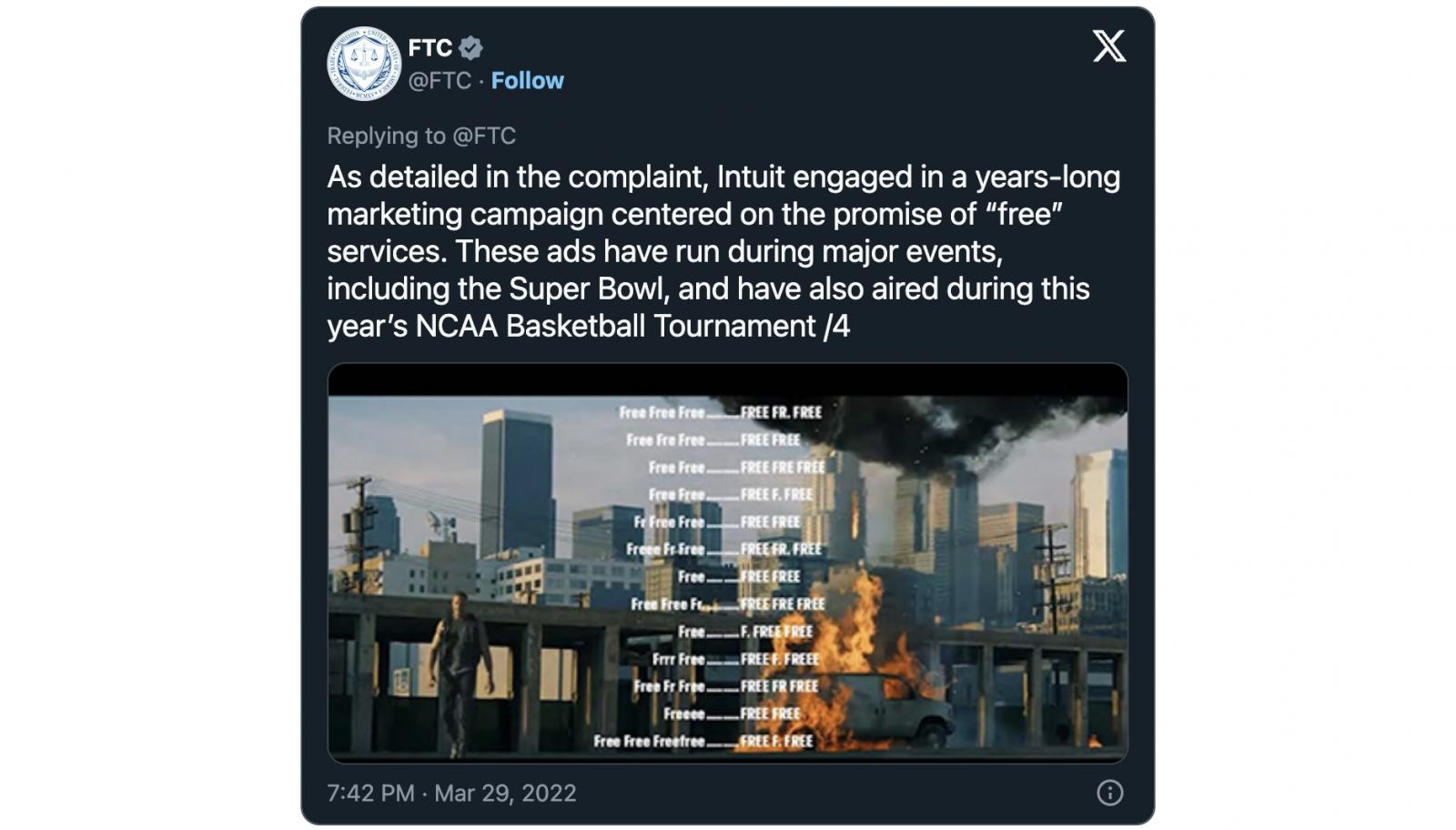

The order comes after the consumer protection watchdog’s investigation into how Intuit promoted its tax preparation software TurboTax as being a “free” product as part of a years-long deceptive advertising campaign, including ads shown during the Super Bowl and the 2022 NCAA Basketball Tournament.

However, the ads were misleading as millions of Americans couldn’t use Turbotax to file their taxes for free over the years, finding that it was all just a waste of time.

As the FTC said, around two-thirds of all tax filers in the U.S. could not use TurboTax for free as advertised by the accounting and tax software provider, instead being hit with charges when it was time to file.

“TurboTax is bombarding consumers with ads for ‘free’ tax filing services, and then hitting them with charges when it’s time to file,” said the Director of the Bureau of Consumer Protection Samuel Levine, two years ago, when FTC filed its lawsuit against Intuit.

Today’s order should stop misleading TurboTax “free tax filing” ads, as it prohibits Intuit from running ads for “free” tax products and services for which many Americans are ineligible.

”The Commission’s Final Order prohibits Intuit from advertising or marketing that any good or service is free unless it is free for all consumers or it discloses clearly and conspicuously and in close proximity to the ‘free’ claim the percentage of taxpayers or consumers that qualify for the free product or service,” the FTC said on Monday.

“Alternatively, if the good or service is not free for a majority of consumers, it could disclose that a majority of consumers do not qualify. The order also requires that Intuit disclose clearly and conspicuously all the terms, conditions, and obligations that are required in order to obtain the ‘free’ good or service.”

The FTC’s order also bars Intuit from providing false information concerning significant aspects of its products or services, including but not limited to pricing, refund policies, consumers’ eligibility for tax credits or deductions, and the ability to accurately file taxes online without reliance on TurboTax’s paid service.

Americans with adjusted gross incomes of $79,000 or less can use products available through the IRS’ Free File Program to file federal and state tax returns for free.