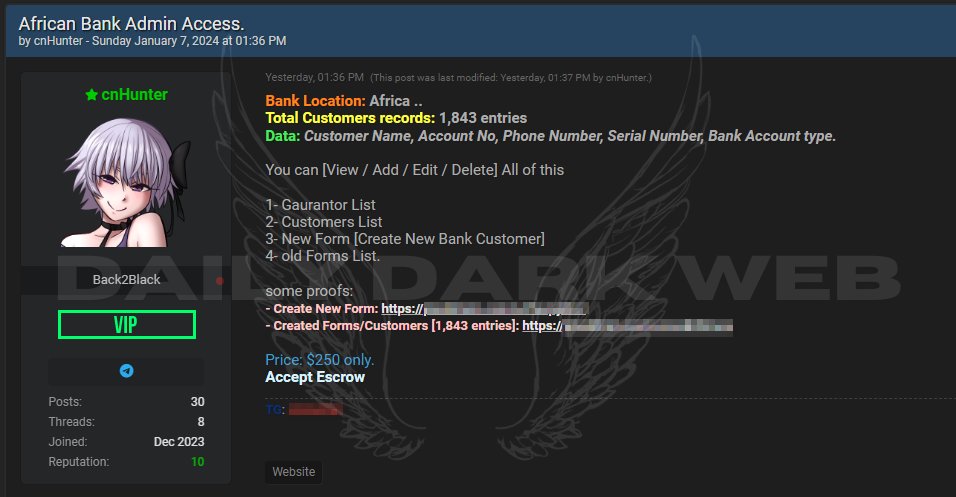

A dark web user has allegedly claimed the African Bank data breach and is purportedly selling sensitive data on the dark web. According to the user, operating under the moniker cnHunter, the datasets contain 1843 customer records, which is up for $250.

The alleged data breach includes sensitive details such as customer names, account numbers, phone numbers, serial numbers, and bank account types.

The African Bank data leak post on the dark web, dated Sunday, January 7, 2024, alleges that the threat actor has complete access to various sections of the bank’s database, offering potential buyers the ability to view, add, edit, and delete information related to guarantor lists, customer lists, and both new and old forms.

The inclusion of hyperlinks to the dark web further suggests an aggressive move by the threat actor to validate their claims.

Alleged African Bank Data Breach and Sale on Dark Web

The Cyber Express sought to gather more information from the organization affected by the data leak. As of now, no official statement or response has been received, leaving the claims surrounding the African Bank data breach unverified.

Additionally, the African Bank website appears to be operational, showing no immediate signs of an intrusion, thereby adding to the uncertainty surrounding the authenticity of the reported breach.

This incident comes at a time when the banking sector globally is grappling with an increase in cyber threats.

Notably, the European Central Bank (ECB) is set to conduct a cyber resilience stress test on 109 directly supervised banks in 2024. The test aims to evaluate how these banks respond to and recover from a successful cyberattack, focusing on recovery measures rather than just preventive capabilities.

The ECB Cyberattack Test

Under the simulated scenario conducted by the ECB, the cyberattack disrupts the daily operations of the banks, prompting them to activate emergency procedures, and contingency plans, and work towards restoring normal operations.

The ECB will subsequently assess the effectiveness of each bank’s response and recovery measures, emphasizing the importance of resilience in the face of online threats, especially modern ransomware gangs and hacktivist groups.

As part of the stress test, 28 banks will undergo an enhanced assessment, providing additional information on how they dealt with the simulated cyberattack.

This diverse sample of banks aims to offer a comprehensive understanding of the euro area banking system’s ability to withstand and recover from such cyber threats.

The African Bank data sale incident is an ongoing story and The Cyber Express will be closely monitoring the situation. We’ll update this post if we have more information or an official confirmation about the African Bank data breach from the organization.

Media Disclaimer: This report is based on internal and external research obtained through various means. The information provided is for reference purposes only, and users bear full responsibility for their reliance on it. The Cyber Express assumes no liability for the accuracy or consequences of using this information.