US bank Wells Fargo has reported a big jump in recommendations from customers after using artificial intelligence (AI) and automation to help families manage the bank accounts, mortgages and financial assets of bereaved relatives.

The bank, which runs over 4,000 branches in the US, is investing in AI and business process management software as it streamlines previously cumbersome and time-consuming processes families were expected to follow when a relative died.

The project, says Sangeeta Doss head of the bank’s Estate Care Centre, has helped Wells Fargo win new customers. In addition, the bank’s net promoter score – a measure of customer satisfaction – has risen from below zero to over 60 for family members dealing with it over a bereavement.

In an interview with Computer Weekly, Doss says the project has also helped the bank to retain more assets and bring in more business from clients. In some cases, family members have transferred their own accounts to Wells Fargo after receiving help during a bereavement, she adds.

Linking IT systems

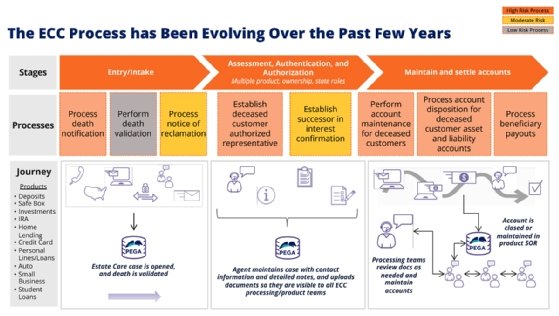

Wells Fargo, the fourth largest bank in the US measured by asset value, asked Doss to run the bank’s newly formed Estate Care Centre (ECC) in 2018. Working initially with a small team, the centre set about finding ways to automate as much of the estate management process as possible.

The bank, which holds $1.9tn in assets, is structured around “vertical” products and services, ranging from deposit accounts to investment funds to safety deposit boxes. This posed a technical challenge, as each part of the bank used its own computer systems, which were unable to communicate with computer systems in other parts of the bank.

Wells Fargo opted to use software from Boston-based business process management specialist Pegasystems to link the Estate Care Centre with computer systems used elsewhere in the business.

“[Before the IT systems were linked], you would have to go to every department separately and report the person deceased for every product and service you own with us”

Sangeeta Doss, Wells Fargo

Doss began the project with two scrum teams made up of 12 to 15 people developing and implementing new business processes. Each programming sprint was justified by the financial return to the business and how much time it was expected to save the bank’s staff, she says.

The first step was to integrate the ECC with Wells Fargo’s main customer record system, Hogan – which is widely used in banking – using the Pega platform. The project made it possible for the bank to use Pega to create case files automatically once the bank received confirmation that a customer had died.

“We got Hogan connected fairly quickly so that we were at least able to pull in the customer information and their accounts and services,” says Doss.

Further integrations followed, first with the bank’s mortgage business, built on Black Knight software, then the credit card business, which ran on a Fiserve platform, followed by the loans business, which ran on technology supplied by Shaw.

The bank is now working on integrating its brokerage services with the ECC. Although the brokerage system does not have the capability to display a “customer view” of data, Doss is working with Pega on a workaround, known as a mashup, that could solve the problem.

Growth of estate care

Wells Fargo has built a dedicated business unit to manage the affairs of deceased customers alongside its software deployment.

The bank deals with around 600,000 deaths a year, which result in transfers of $32bn annually.

The ECC now employs some 800 people worldwide, about half of whom spend their time on the phone helping bereaved relatives.

Wells Fargo has been able to reduce the risk of human error and delays that could mean missing deadlines set by regulators by automating processes as far as possible.

The bank receives between 30% and 40% of its death notifications from the US Treasury, equivalent to 1,200 notifications a day. Other notifications come in from family members or returned post.

The bank’s Pega platform is able to verify that a death has taken place, if necessary, by automatically checking with third-party data providers. The software is also able to navigate the requirements of each US state, which have different legal processes for managing probate.

Customers benefit by only having to explain their situation once when they first contact the bank after a death in the family.

Specialist staff use the bank’s Pega platform to take detailed case notes and highlight high-priority actions, such as legal action or any urgent research required. They are able to advise relatives on actions they need to take, for example to file probate documents in court where necessary, when they call in.

“It’s not a first-time resolution because there are multiple steps to go through, but the family never has to repeat their story, and the agent will pick up where they left off,” says Doss.

Family members can hand over documents in person at a branch, send them by post or fax, or upload them to a website, and the software is able to allocate copies of the correct documents to each bank department. “We never ask the family to send the same document more than once,” says Doss.

The bank uses Pega to manage strict regulatory timeframes, which in the case of a mortgage, for example, require the bank to respond within five days.

Managing the project

Doss says it was important to get the rest of the business on board with the estate management project.

“One of the successes we had is that I went and talked to every product leader. I am representing their product at the end of a customer’s life, so it was very important for me to ensure there was transparency there,” she says.

“They have pride over their products and they want their products represented well, so I think those relationships and those partnerships are key,” she adds.

Doss sometimes spent three or four days in meeting rooms with department heads before reaching an agreement.

“Wells Fargo is a very vertical product base, and I am trying to create a horizontal experience – none of these applications talk to each other,” she says.

There are still some banking systems that cannot be fully automated, which means staff have to “swivel chairs” to alternate between three computer terminals on their desk, including old-fashioned green screen terminals.

“There is still a lot of manual work, but Pega at least directs the workflow so that the team know what the next step to take is,” says Doss.

Pega has paid for itself, according to Doss, by reducing errors and losses to the bank. Its use of automation means people spend less time filling in systems of record that are not user friendly and that require operators to have specialist knowledge to know what codes need to be entered.

One senior manager told Doss that she used to receive a complaint every week but now doesn’t receive any. “That is how I know the system is working,” she says.

The department has also set up a research and escalation team to troubleshoot problems. In some cases, branches may not have set up products correctly or a family member may have misunderstood their legal rights when they set up a power of attorney.

“We find these pain points and we try to find solutions so we can really help the family with what the [deceased person] probably intended,” says Doss.

Sharp turnaround

There has been a dramatic turnaround in the six years since Wells Fargo began its programme to link multiple IT systems across the bank to make it easier to manage the estates of deceased customers.

Back then, funeral homes would warn people that they would need to supply Wells Fargo with multiple copies of the death certificate when a relative died.

“You would have to literally go to every department separately and report the person deceased for every product and service you own with us,” says Doss.

Banking staff at branches typically dealt with only one bereavement a month, which meant they did not always have the specialist knowledge to manage the client’s financial estate.

That could lead to mistakes such as sending the wrong amount to the wrong beneficiary, failing to obtain the correct documents, or miscalculating how to divide funds correctly when there were multiple beneficiaries.

If a banker failed to restrain the account as soon as the bank received a death notice and someone took funds from the account, the bank was legally responsible for the missing money.

“The experience used to be very poor. We took lots of losses, lots of complaints,” says Doss.

Next stop: AI

Doss now has four scrum teams working on sprints to update and introduce new workflows every three weeks.

One priority is to redesign the computer interface used by call centre agents to make it easier for them to find information on the screen quickly, by introducing colour displays that will make key information stand out.

Agents have to navigate multiple computer systems to find the information they need, while trying to help customers who are grieving, and crying at times.

Being able to find information more quickly could make a huge difference, Doss tells Computer Weekly. “They are looking at death certificates all day long, so the easier and simpler we can make their user interface, the more successful they will be,” she says.

The bank plans to upgrade its Pega software from version 8.8 to Pega Infinity 2023, which will allow it to use more AI features. Another advantage is that the updated software platform is compatible with the American Disability Act, she says.

Doss is looking at using Pega’s AI-powered Knowledge Buddy to help agents find information more quickly. Rather than searching through documents, the technology will make it possible for agents to find answers by asking questions of the AI system which will be trained using the bank’s internal documents.

“That will be very helpful because our agents will not have to read through all these complex procedures while they are on the phone talking to someone, trying to work through their case,” she says.

The bank is also looking at a low-code app development tool, Pega’s Blueprint, that allows organisations to design business processes by selecting pull-down menus, as a way to speed up development.

“We have some applications that we are going to be retiring…so we are going to build those workflows into Pega,” she says. “Blueprint will be great for that.”

Doss is also looking at introducing another platform, Customer Decision Hub. The platform, also supplied by Pega, is already used elsewhere in Wells Fargo and could be used to nudge customers to nominate beneficiaries for their accounts.

“One of the biggest opportunities we have is for customers who don’t have a beneficiary’s name on their account. Decision Hub could identify that and prompt them when they use an ATM or login online, and make it easy for them to make those updates,” she says.

In the longer term, Wells Fargo is looking to move its IT systems from an on-premise datacentre to the cloud. “We may have to do a private cloud first, but we are in full discussions right now,” says Doss.