In last year’s edition of the Security Navigator we noted that the Manufacturing Industry appeared to be totally over-represented in our dataset of Cyber Extortion victims. Neither the number of businesses nor their average revenue particularly stood out to explain this.

Manufacturing was also the most represented Industry in our CyberSOC dataset – contributing more Incidents than any other sector.

We found this trend confirmed in 2023 – so much in fact that we decided to take a closer look. So let’s examine some possible explanations.

And debunk them.

Hunting for possible explanations

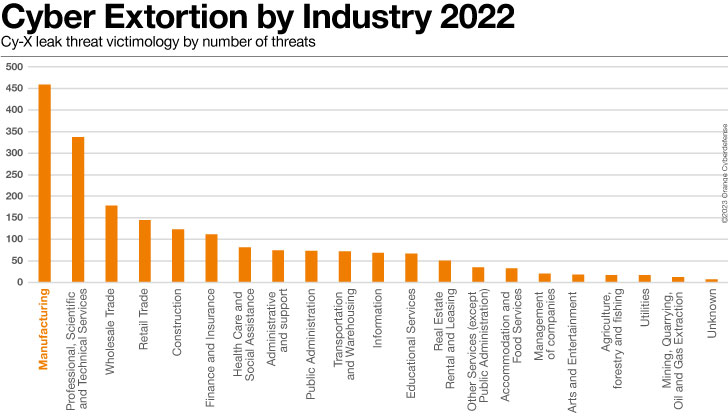

Manufacturing is still the most impacted industry in our Cyber Extortion dataset in 2023, as tracked by monitoring double-extortion leak sites. Indeed, this sector now represents more than 20% of all victims since we started observing the leak sites in the beginning of 2020.

Approximately 28% of all our clients are from Manufacturing, contributing with an overall share of 31% of all potential incidents we investigated.

We note that 58% of the Incidents this industry deals with are internally caused, 32% were externally caused, 1% was classified as “Partner” or 3rd parties. When external threat actors had caused the security incident, we observed the top 3 threat actions were Web Attacks, Port Scanning and Phishing.

On the other hand, Manufacturing has the lowest apparent number of confirmed security vulnerabilities per IT Asset in our Vulnerability scanning dataset. Our pentesting teams on the other hand report 4.81 CVSS findings per day, which is quite a bit above the average of 3.61 across all other industries.

Several questions present themselves, which we will attempt to examine here:

- What part does Operation Technology play?

- Are businesses in Manufacturing more vulnerable?

- Is the Manufacturing sector being deliberately targeted more?

- Do our Manufacturing clients experience more incidents?

What part does OT play?

A tempting assumption to make is that businesses in the Manufacturing sector are compromised more often via notoriously insecure Operational Technology (OT) or Internet of Things (IoT) systems. Plants and factories can often not afford to be disrupted or shut down and that Manufacturing is therefore a soft target for extortionists.

It sure sounds plausible. The catch is: we don’t see these theories supported in our data.

The attack against US Energy giant Colonial Pipeline was probably the most notable recent example of a successful attack against an industrial facility.

Discover the latest in cybersecurity with comprehensive “Security Navigator 2023” report. This research-driven report is based on 100% first-hand information from 17 global SOCs and 13 CyberSOCs of Orange Cyberdefense, the CERT, Epidemiology Labs and World Watch and provides a wealth of valuable information and insights into the current and future threat landscape.

In July this year US intelligence agencies even warned of a hacking toolset dubbed ‘Pipedream’ that is designed target specific Industrial Control Systems. But it is not clear to us if or when these tools have ever been encountered in the wild. Apart from the infamous Stuxnet attack from 2010, one struggles to recall a single cyber security incident where the entry point was an OT system.

At Colonial Pipeline the backend ‘conventional’ administrative systems were compromised first. Looking more closely, this is the case for almost all reported incidents at industrial facilities.

Are businesses in the Manufacturing sector more vulnerable to attacks?

To answer this questions we examined a set of 3 million vulnerability scan findings, and a sample of 1,400 Ethical Hacking reports.

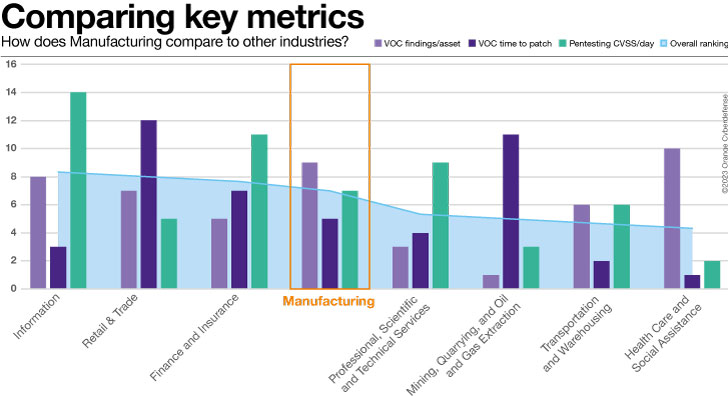

We derived three metrics that facilitate somewhat normalized comparisons across the industries in our client base:

VOC scanning findings per asset, time to patch, Pentest findings per day of testing.

If we rank industries for their performance on each of those metrics and sort from worst to best, then our clients in the Manufacturing sector arrives in 5th place out of 12 comparable industries.

The chart below shows the overall *ranking* of our Manufacturing clients out of comparable industries.

VOC unique findings/asset

On this metric there were seven other industries that performed better than Manufacturing.

While we have a comparatively high number of assets from Manufacturing clients in our scanning dataset, we report far fewer Findings per Asset than the average across all industries. Almost 10 times fewer, in fact.

Time to patch

On this metric 6 other industries ranked better than Manufacturing. The average age of all findings for this industry is 419 days, which is a concerning number and worse than recorded for eight other industries in this dataset.

Pentesting findings

We observe that the average CVSS Per Day was 4.81, compared to 3.61 on average for clients in all other sectors in the dataset – 33% higher.

Is the Manufacturing sector being targeted more by extortionists?

We use the North American Industry Classification System – NAICS – classification system when categorizing our clients.

A consideration of double-extortion victim counts per industry reveals a very interesting pattern: Of the 10 industries with the most recorded victims in the dataset, 7 are also counted amongst the biggest industries by entity count.

Manufacturing however, is a clear trend-breaker.

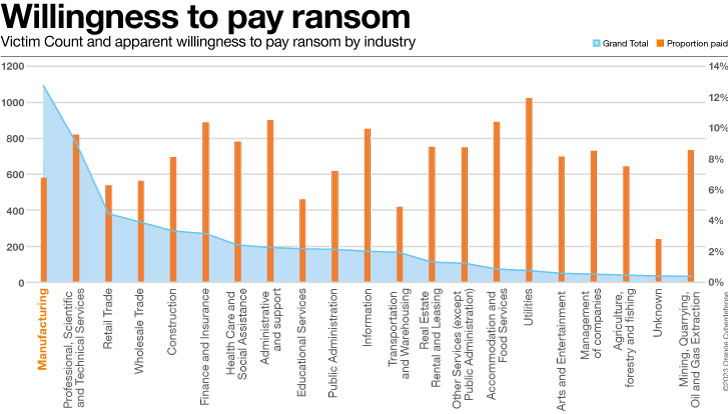

Another factor raises questions: if businesses in the Manufacturing sector were more willing to pay ransom that would make them more attractive as victims. But then we would expect to see such businesses featuring on the ‘name and shame’ leak site less often, not more.

Do our Manufacturing clients experience more incidents?

The Manufacturing industry once again generated the highest number of Incidents as a percentage of the total in our CyberSOC dataset. 31% of all Incidents are generated for the 28% of our clients that are from this sector.

The Incident data lacks context, however. To establish a baseline for comparison, we assign customers a ‘Coverage Score’ between 0 and 5 in 8 different ‘domains’ of Threat Detection, accounting for a maximum total detection score of 40.

We use the coverage score to normalize the incident count. Put simply, the lower a client’s assessed coverage score is, the more this adjustment will ‘boost’ the number of Incidents in this comparison. The logic is that a low amount of coverage will just not show us a lot of incidents, though they very likely occurr.

If we adjust the True Positive and False Positive Incidents as described above, we still see more than seven times as many Incidents per clients from Manufacturing than the average for all industries.

In a similar comparison, limited only to Perimeter Security, and only Medium Sized business, Manufacturing ranks 1st with the most Incidents per Customer out of 7 comparable Industries.

Conclusion

We ruled out a massive impact of OT security vulnerabilities, and therefore focus on regular IT systems. Our scanning teams assessed a large number of targets but reported relatively few vulnerabilities per asset. Overall, we rank the Manufacturing sector as 5th or 6th weakest of all industries from a vulnerability point of view.

The question of why we consistently record such a high proportion of victims from the Manufacturing industry is not readily answered with the data we have. We believe that in the end it still comes down to the level of vulnerability, best reflected in our Penetration Testing, and Findings Age data.

All of our data points to the fact that attackers are mostly opportunistic. Rather than deliberately singling industries out, they simply compromise businesses that are vulnerable.

The customers represented in our datasets have engaged with us for Vulnerability Assessment or Managed Detection, and therefore represent relatively ‘mature’ examples of that industry. We can deduce that average businesses in this sector would benchmark worse in terms of vulnerabilities. Whether the high number of victims we observe on attacker leak-sites is a direct reflection of the high number of overall victims in this sector, or the skewed reflection of an industry that refuses to concede to initial ransom demands, is not entirely clear.

What does appear likely, however, is that vulnerability is the primary factor that determines which businesses get compromised and extorted – in this sector as much as any other.

This is just an excerpt of the analysis. More details on how different Industries performed in comparison to others, as well as more CyberSOC, Pentesting and VOC data (along with plenty of other interesting research topics) can be found in the Security Navigator. It’s free of charge, so have a look. It’s worth it!

Note: This article has been written and contributed by Charl van der Walt, Head of Security Research at Orange Cyberdefense.