NBN Co is set to make permanent some sizable price cuts to its three high-end products that offer better uplink speeds.

The company on Wednesday published its three-year pricing roadmap and statement of pricing intent for the first regulated period covered by its recently-approved special access undertaking (SAU).

It contains few surprises for customers of its residential plans.

However, for customers interested in its fibre-only plans that come with better uplink speeds – 250/100Mbps, 500/200Mbps and 1000/400Mbps – the company will make big permanent price cuts from July 2024.

Take-up of those plans is currently limited by the fibre footprint and by the premium that must be paid.

Residential plans had their uplink slashed in 2019 to make them cheaper; but the pandemic tested the extent to which some users could make do with much lower uplink rates.

Currently, retail service providers are collecting rebates on sales of these higher uplink plans – $25 a month on 250/100Mbps and $60 a month on the 500Mbps and 1000Mbps tiers.

The rebate had been set to cease in June 2024, but NBN Co said it had decided to make permanent price cuts to these high-speed tiers.

The net effect is that there will be less of a step up in price to move from a 250Mbps or up to gigabit residential plan with a 25Mbps to 50Mbps uplink, to a plan that comes with much better uplink speeds.

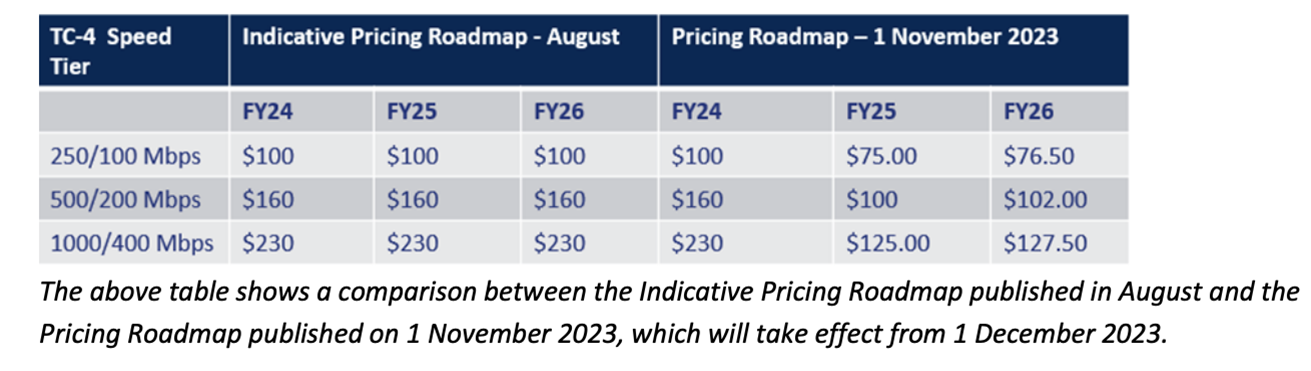

Under an indicative pricing roadmap that NBN Co published in August, the wholesale prices would have remained the same until FY26.

Now, NBN Co said that a 250/100Mbps plan will go from $100 wholesale today, to $75 a month in FY25.

The 500/200Mbps plan will reduce from $160 a month today to $100 a month, and the 1000/400Mbps from $230 a month to $125 a month.

As presented, they will ‘bottom out’ in cost in FY25; by FY26 the plans will creep up by between $1.50 and $2.50 a month.

That is in line with broader price movements: all NBN prices will be more expensive in FY26 compared to FY25.

NBN Co pledged more focus on the highest speed tier services, as it sought to harness billions of dollars being ploughed into network upgrades.

“NBN Co intends to continue focusing on strategies to stimulate growth in demand for these higher speed tiers amongst end customer groups who would value the higher speed tiers, including as bandwidth demand increases amongst end customers, so as to maximise efficient use of NBN Co’s upgraded network,” it said.

Churn event

The big change to occur in the first regulatory cycle is what happens to the 50/20Mbps residential tier, where a substantial $5 a month wholesale price rise is to occur.

Throughout the SAU process, it has been hotly debated how retail service providers (RSPs) and customers in the tier will react: whether they’ll shift up to the 100/20Mbps product (either voluntarily, or because the RSP re-homes them), or downgrade to 25Mbps, the new basic broadband tier on the NBN.

NBN Co thinks both will happen.

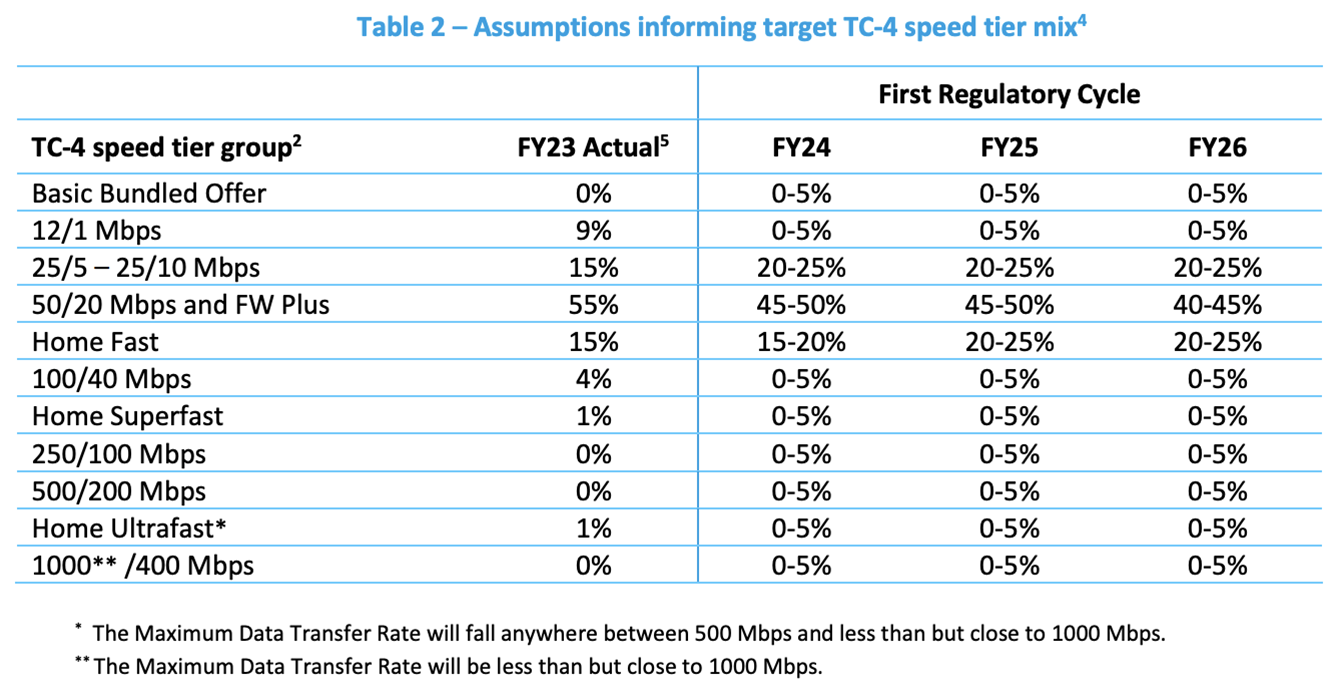

It thinks the proportion of customers today on 25Mbps will grow from 15 percent today to up to 25 percent by FY26; with some of that coming from upgraders from 12Mbps, and others from price-conscious downgrades from the 50Mbps tier.

Its expectation is that the proportion of customers on 50Mbps will shrink from 55 percent today to as little as 40 percent in three years, due to its pricing structure.

But only a maximum of 10 percent is set to move up to 100/20Mbps, meaning about five percent will probably drop down to 25/5Mbps.

Price isn’t the only factor driving speed tier movements; NBN Co’s fibre overbuild programme, called fibre connect, will also mean more customers have access to full fibre connections by FY26.

This isn’t predicted to meaningfully change the proportion of customers on plans above 100/20Mbps in the next three years, but it will drive customers up to 100/20Mbps, because that’s a prerequisite for getting the upgrade from fibre-to-the-node approved.

Brendan O’Donoghue, NBN Co’s executive general manager for sales, told a recent CommsDay forum that fibre connect is a “big churn opportunity” for retailers, with “38 percent of end users … using fibre connect as an opportunity to change their internet service provider.”

Future improvements

The statement of pricing intent flags the possible introduction of new speed tiers in the next three years.

“Future enhancements may include appropriately improving downlink and uplink headline speeds to leverage network capability improvements, meet customer demand and respond to competition,” it wrote.

It specifically calls out plans to introduce new fixed wireless speed tiers; it’s not clear if other new tiers are planned for the fixed network to push it beyond a gigabit, but multi-gigabit speeds are certainly on the company’s roadmap.

NBN Co also said it would look to develop a product for “end customers with low usage and basic connectivity requirements.”

The product would particularly appeal to “low usage broadband end consumers who are accessing NBN-based services via retail plans that have limited data allowance and which rely on variable CVC pricing that is to be reduced,” the company said.