Credit card fraud has matured into a service-based criminal economy where stolen cards, malware, and support are bundled and sold like commercial products.

Underground “dump shops” such as Findsome, UltimateShop, and Brian’s Club now operate as full-fledged carding-as-a-service (CaaS) marketplaces, mirroring legitimate e‑commerce platforms in usability, scale, and customer focus.

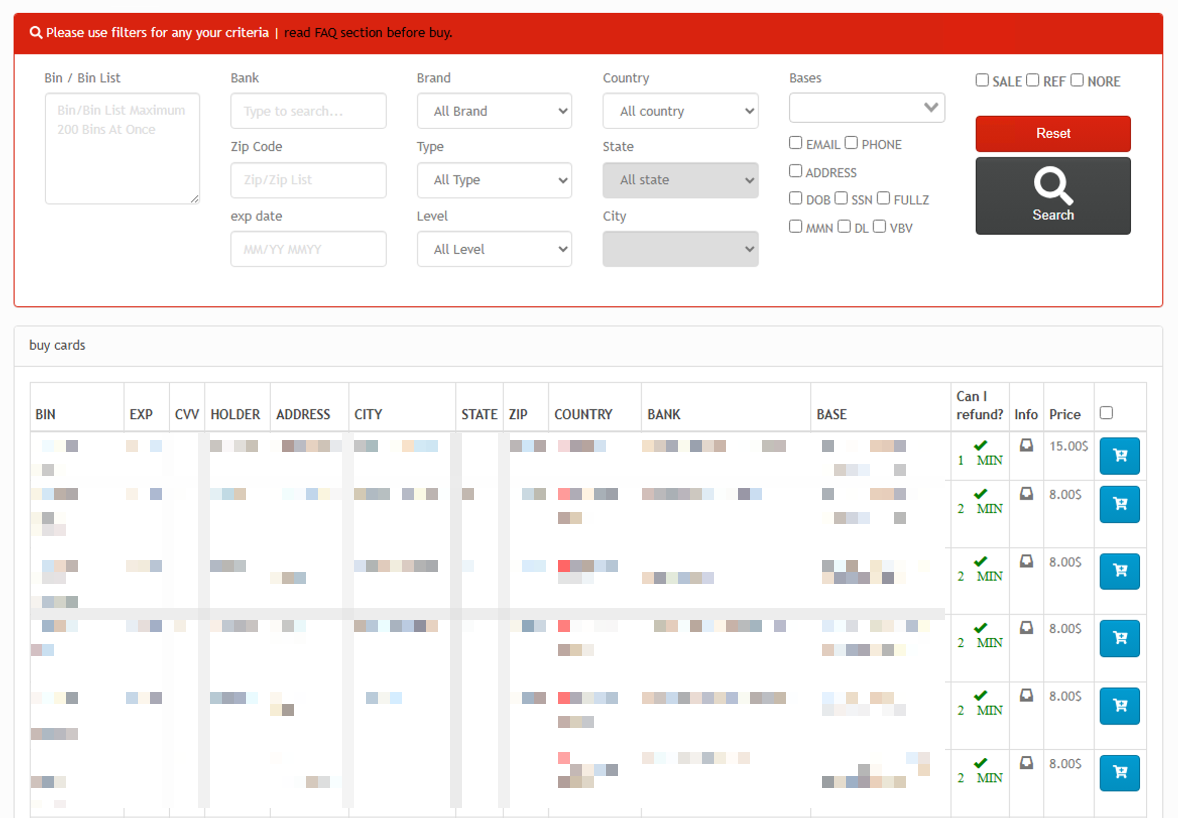

At the core of this ecosystem is a structured trade in different types of payment data. Card numbers (“CVV”) typically include the primary account number, cardholder name, expiry date, CVV2 code, and often billing address and phone number, enabling card-not-present fraud in online stores.

According to report “Dumps” contain raw magnetic-stripe track data used to clone physical cards for in‑store purchases and ATM withdrawals, while “Fullz” combine card data with sensitive personal information such as date of birth or national identifiers, opening the door to identity theft and account takeover.

By packaging financial data with rich PII, carders make direct monetary loss only the starting point of the damage for victims.

Phishing-as-a-service sector and broader fraud-as-a-service offerings allow low-skilled actors to spin up convincing fake banking or retailer portals, harvest payment card data, and sell it upstream to resellers.

Physical tools, including modern “shimming” devices targeting EMV chips, extend compromise beyond ATMs to fuel pumps and point-of-sale terminals, further enriching underground inventories.

Carding-as-a-Service Marketplaces

At the same time, point-of-sale malware families and modern infostealers siphon payment records from compromised endpoints, often alongside credentials and other personal identifiers that increase resale value.

Card data is also captured directly from payment flows using scripts injected through cross-site scripting or other web vulnerabilities, with “sniffer” code stealing details at checkout in real time.

Findsome, UltimateShop, and Brian’s Club have emerged as key hubs in this economy, offering searchable inventories with filters for BIN, country, issuing bank, card type, and even specific “bases” tied to the same breach or supplier.

Buyers can sort by price, geography, or the presence of additional PII, and often benefit from integrated or third‑party checker services that validate cards immediately after purchase.

Refund policies and automated “check time” windows are critical differentiators, as disputes frequently center on invalid or outdated cards; marketplaces compete on perceived reliability as much as on raw volume.

Most operate as aggregators, sourcing from multiple resellers whose aliases are visible in batch names, which boosts diversity but also introduces inconsistencies and overlapping data sets across platforms.

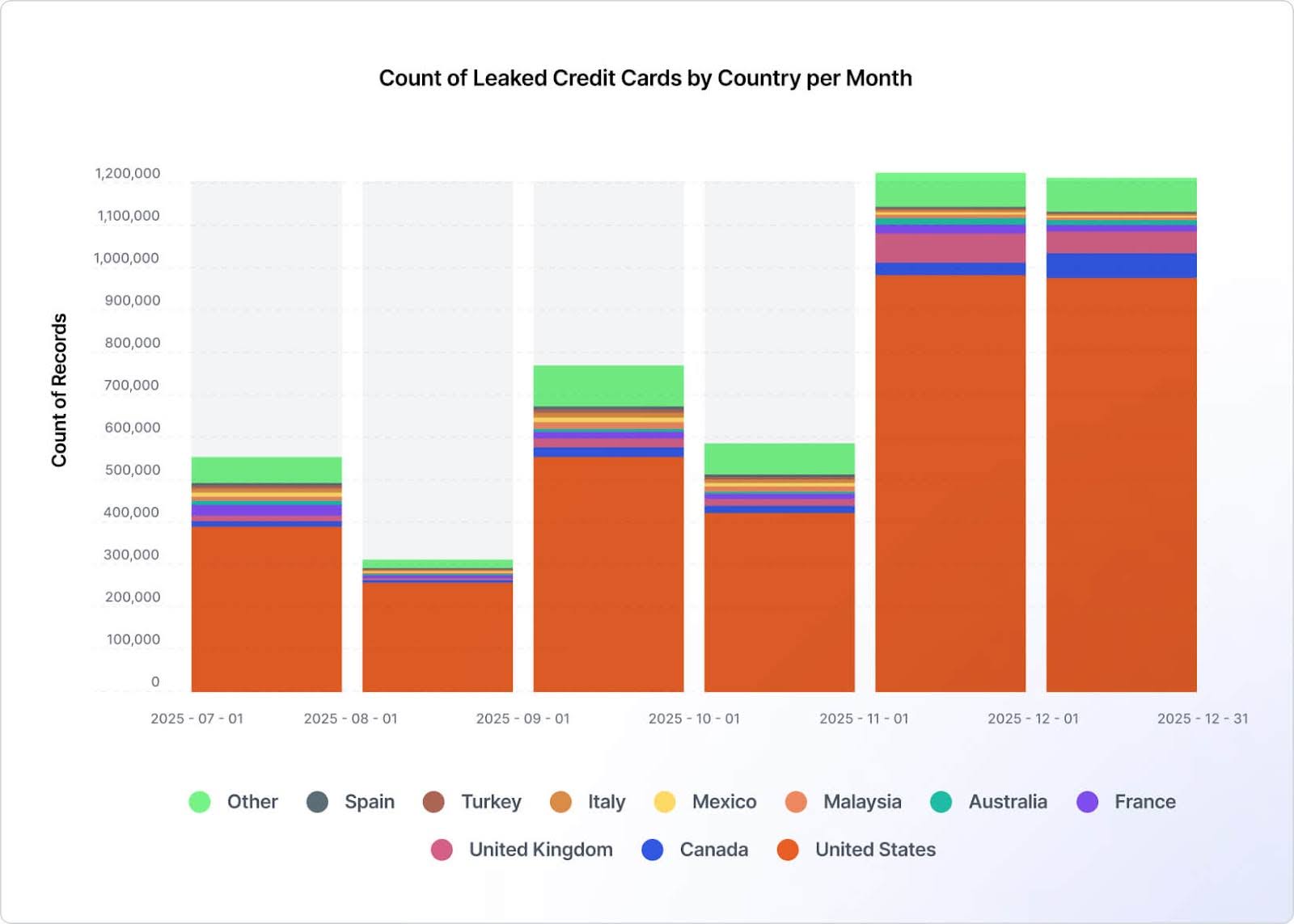

The largest volume was recorded in November and December, likely due to the shopping season (e.g., Black Friday and Cyber Monday) that occurs around that time.

All three major marketplaces accept Bitcoin, while Findsome also supports alternative cryptocurrencies such as Litecoin and Zcash, lowering barriers for buyers seeking anonymity.

Low minimum deposits sometimes as little as zero dollars combined with deposit bonuses between 5% and 12% further encourage recurring use and larger balance funding.

Operators host their services on the dark web and maintain rotating surface‑web mirrors to increase accessibility, a tactic that has spawned a long tail of phishing domains impersonating legitimate shops to defraud would‑be criminals themselves.

Surge in Credit Card Fraud

To preserve trust, administrators regularly publish verified domain lists and warn users about scam clones.

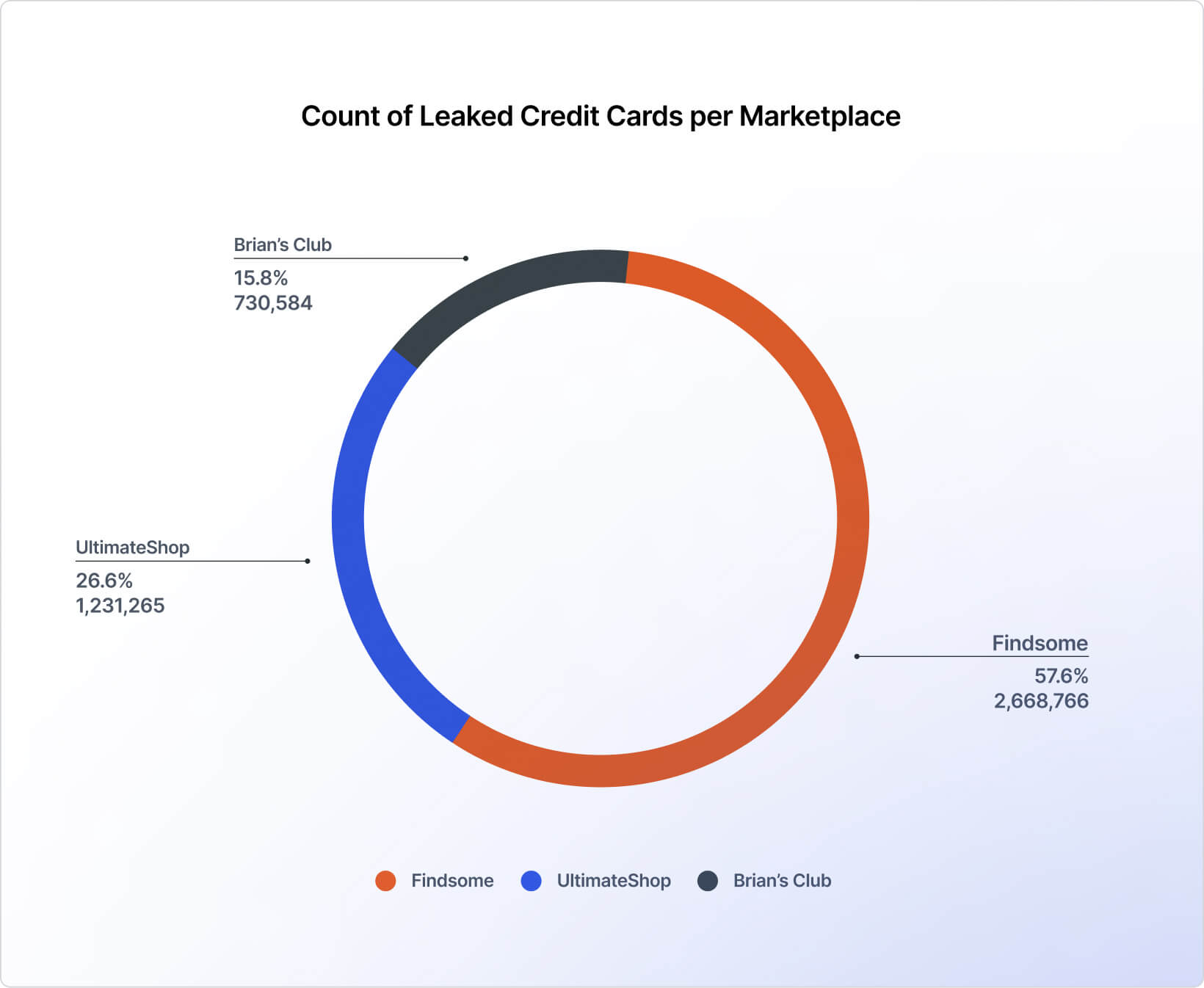

Market statistics highlight how embedded this ecosystem has become. Recent analysis shows Findsome controlling roughly 57.6% of the examined carding market, with UltimateShop at 26.6% and Brian’s Club at 15.8%, underscoring strong consolidation around a few entrenched players.

Across these platforms, Visa cards account for about 60.4% of leaked credit cards, followed by Mastercard at 32.3%, American Express at 4.3%, and Discover at 3%, a distribution that closely tracks U.S. card usage rather than global market share.

Most victims are located in the United States, with Canada and the United Kingdom trailing at a distance, and card leaks spike around peak shopping months such as November and December.

In the majority of cases, leaked cards are accompanied by an email address, phone number, or both 99.4% on UltimateShop, 87.7% on Findsome, and 75.7% on Brian’s Club amplifying the risk of identity fraud, targeted phishing, and long‑term account compromise.

A defense‑in‑depth strategy is essential: hardening web applications and payment pages against client-side attacks, tightening phishing and malware defenses, enforcing strong authentication, and maintaining continuous monitoring for exposed cards and credentials on dark‑web platforms.

For organizations, the rise of CaaS underscores that traditional fraud monitoring focused on individual transactions is no longer sufficient.

Criminals increasingly monetize stolen cards and identity data long before fraud reaches issuer detection models, exploiting gaps between payment security, identity protection, and visibility into underground markets.

By correlating leaked BINs and account data to internal records and responding quickly through card reissuance, credential resets, and enhanced fraud analytics, financial institutions can limit both immediate financial losses and the broader identity-driven abuse that defines today’s carding-as-a-service economy.

Follow us on Google News, LinkedIn, and X to Get Instant Updates and Set GBH as a Preferred Source in Google.